How To Invest For Retirement

I constantly read in the news that many Americans aren’t saving enough money for retirement. It’s easy to be overwhelmed by all the options for retirement saving, the jargon, and conflicting information. This post outlines easy steps on how to invest money for a long-term goal, such as retirement1.

Disclaimer: I am not a financial professional. This advice comes only from my reading, some school, and personal experience. Please talk to a financial adviser if you have questions.

Summary

- Create a Vanguard online account.2 Do it now; it is much better to start investing early, rather than waiting until you have or earn more money3.

- Put your initial investment in a Target Retirement fund, in a tax-advantaged account.4

- Regularly save as much money as you can into that fund, e.g. every month or pay period.5

- Analyze your portfolio annually.6

- Don’t pay attention to TV personalities or columnists or bloggers who tell you what the hottest stock or latest fad is.7

Case Study

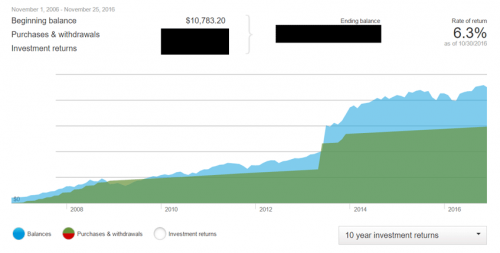

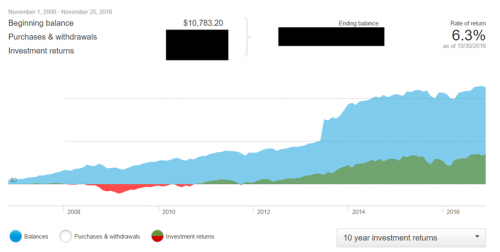

As an example of how this strategy has worked for me, here are a couple charts provided by Vanguard for my own account. These charts show the past 10 years. (I began investing around 2003.)

This first chart shows the balance for my account (blue area) compared to the amount of money I put in (green area). At the time of this writing, about 30% my balance is from “free” money — the returns from my investments.

This second chart shows my balance (blue area) compared to the stock market as a whole (green/red area). As you can see, I’ve received about a 6% rate of return since 2006 — it’s not 10%, but pretty good considering this period spans the Great Recession. My balance didn’t grow much during the recession — and in 2008 even lost more money than I put in — but over the long-term the result was positive.

As another example, The New York Times created an interesting graphic showing how investments performed in the stock market over the past century.

Notes

1 You may be saving for retirement (usually around age 65), or for college tuition, or maybe to pay off bad debt. By “long-term” I mean at least ten years. For shorter-term goals, you’d probably want to use a less risky type of investment.

The amount you need to save for retirement will vary based on your situation, but here are some ideas:

- Plan on needing 70% of what you’re currently making — about $1 million on average.

- Fidelity recommends the following targets: 10x your annual salary saved by age 67; 7x by age 55; 4x by age 45; and 2x by age 35.

- You can use a calculator like Prudential’s retirement calculator to get a better idea for your particular situation.

2 Your investments don’t have to be with Vanguard, but they are an excellent choice. They have some of the lowest fees, and they have good customer service.

If your employer has a 401(k), consider using that — especially if they match your contributions. It can then be rolled over into a Vanguard account if you leave your job.

3 The earlier you start, the better. Even if you can’t contribute as much money as you’d like, start investing now. This is because investing works on the principle of compound interest — rather than receiving the interest that you earn on your investment, it goes back into your savings to be used to generate even more interest.

To quote a random person on the internet:

My favorite example is that of the twin brothers who invest with annual gains of 12% each: one twin saves $2,000 from age 19 to 26 (a total of $16,000) and then stops saving; the other twin doesn’t start saving until age 27 but then puts away $2,000 every year until age 65 (a total of $78,000). Do the math, and you will see that the savings of the second twin, growing at 12% every year, *never* catch up with those of the first one.

4 Target-date funds (TDFs), offered by most mutual fund companies, aim to provide index funds automatically balanced for your timeline. Simply choose one based on your target retirement date. Index funds are low cost, diversified, and perform as well as actively-managed funds (usually better). There’s no need to invest in additional funds alongside a TDF — that may skew your portfolio. TDFs are already designed for a good mix of assets.

If possible, your investment should be in a tax-advantaged account, such as a Roth IRA, traditional IRA, or 401(k). Tax-advantaged accounts also have the incentive of penalizing you if you withdraw money from them before retirement age.

5 Many investors try to time the market, or get nervous or greedy when watching the stock market, actually making them buy high and sell low. By contributing the same amount at regular intervals, you can avoid these mistakes. This is called “dollar cost averaging”, because your average cost over time is lower: when stock prices are low, your contribution purchases more shares; when stock prices are high, you don’t waste money buying more shares.

How much money do you invest? Most advisers recommend 10%-20% of your income — 12%-15% is a good target. You can increase your contributions when you’re at peak earning potential (usually around age 45).

6 As the target date draws near, you should have fewer stocks and more low-risk investments like bonds. Luckily, TDFs should handle this for you. They contain mostly stocks when they are created, but are automatically shifted to less risky investments (such as bonds or cash) as the target date gets close. Regardless, you should monitor your investments and assess if they are still fulfilling your strategy.

7 TV personalities and bloggers may get paid to promote a stock. At the very least, they make money by publishing ideas or news, not by making you money. Chasing stock tips is only good if you have money to burn in stock market speculation. Saving money over the long-term is a better strategy for your future goals.

Don’t be an emotional investor. The best thing to do is ignore those financial shows and the daily economic news.

Further Reading

- Personal Investing by Yodhia Antariksa has the same as what I’ve written here, but in PowerPoint format.

- NerdWallet was recommended by a financial adviser.

- The Motley Fool is a classic investing site.

- Investopedia also seems like a good resource.

|